sacramento county tax rate

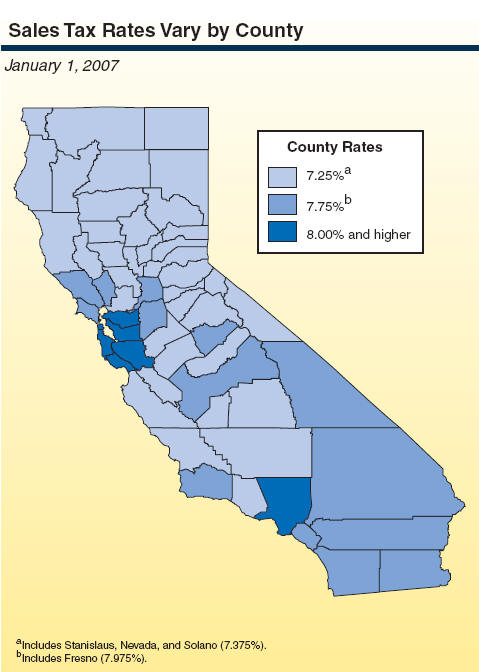

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. 36 rows The Sacramento County Sales Tax is 025.

Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento County totaling 025.

. How much is county transfer tax in Sacramento County. The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. View the E-Prop-Tax page for more information.

The median property tax in Sacramento County. A supplemental tax bill is created when a property is reassessed from a change in ownership or new construction. The statewide tax rate is 725.

The December 2020 total local sales tax rate was also 8750. T he tax rate is. This is the total of state county and city sales tax rates.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. A county-wide sales tax rate of 025 is. 55 for each 500 or fractional part thereof of the.

Those district tax rates range from 010 to. The current total local sales tax rate in Sacramento County CA is 7750. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

The current total local sales tax rate in Sacramento CA is 8750. The California state sales tax rate is currently 6. The Sacramento County sales tax rate is 025.

The 2018 United States Supreme Court decision in South Dakota v. 5 rows The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025. Has impacted many state nexus laws and sales tax collection requirements.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the. The December 2020 total local sales tax rate was also 7750. What is the sales tax rate in Sacramento California.

Box 508 Sacramento CA 95812-0508 Please ensure that mailed payments have a US. 6 rows The Sacramento County California sales tax is 775 consisting of 600 California state sales. The minimum combined 2022 sales tax rate for Sacramento California is.

Compilation of Tax Rates by Code Area. The minimum combined 2020 sales tax rate for Sacramento California is 875. After searching and selecting a parcel.

To review the rules in California visit our state-by-state guide. This is the total of state county and city sales tax rates. In Sacramento County only the City of Sacramento has.

Sacramento County collects on average 068 of a propertys. 2021-2022 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1. Tax Rate Areas Sacramento County 2022.

The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and. How much is the documentary transfer tax. Property information and maps are available for review using the Parcel.

This is the total of state and county sales tax rates. T he tax rate is 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax.

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Transfer Tax Alameda County California Who Pays What

Alabama Property Tax H R Block

Sales Tax Rates Finance Business

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

Sacramento Cost Of Living 2022 Is Sacramento Affordable Data

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

Los Angeles County Ca Property Tax Search And Records Propertyshark

All About California Sales Tax Smartasset

California Sales Tax Rates Vary By City And County Econtax Blog

California S Tax System A Primer

California S Tax Revenue System Isn T Fair For All California Budget And Policy Center

The Property Tax Inheritance Exclusion

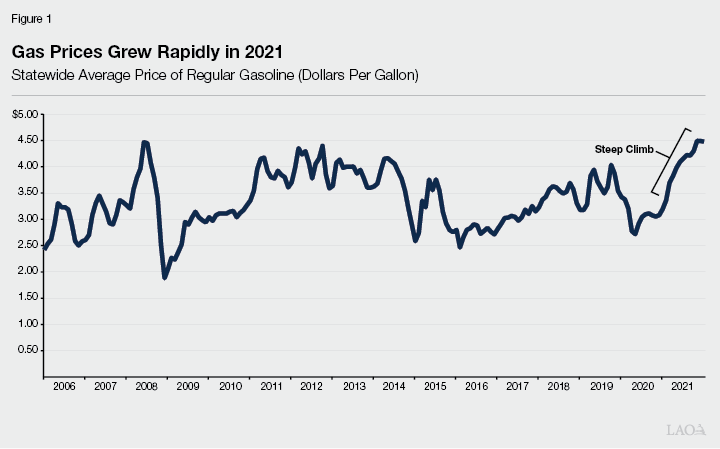

The 2022 23 Budget Fuel Tax Rates

Know Your Flood Hazard City Of Sacramento